What Happened at the Latest FOMC Meeting

A 25 basis point cut to the Federal Funds Rate, targeting a range of 4.00%–4.25%, was made as a policy decision by the Federal Reserve at its September 2025 meeting.

Key takeaways from the Fed’s statement and new projections include:

- Growth Moderation: Economic activity and job gains have slowed, but employment remains solid.

- Inflation remains elevated, but the Fed appears more willing to consider inflation directly related to potential growth concerns moving forward.

- Additional Easing Likely: The Fed indicated the possibility of an additional two cuts to the Fed Funds Rate before the end of the year.

Relevance to Indian Traders.

How This Rate Cut Matters for Indian Markets

As traders or soon-to-be ones on platforms like Marketbhai, understanding channels of impact is critical:

| Channel | Immediate Effect | Potential Mid & Long-Term Effects |

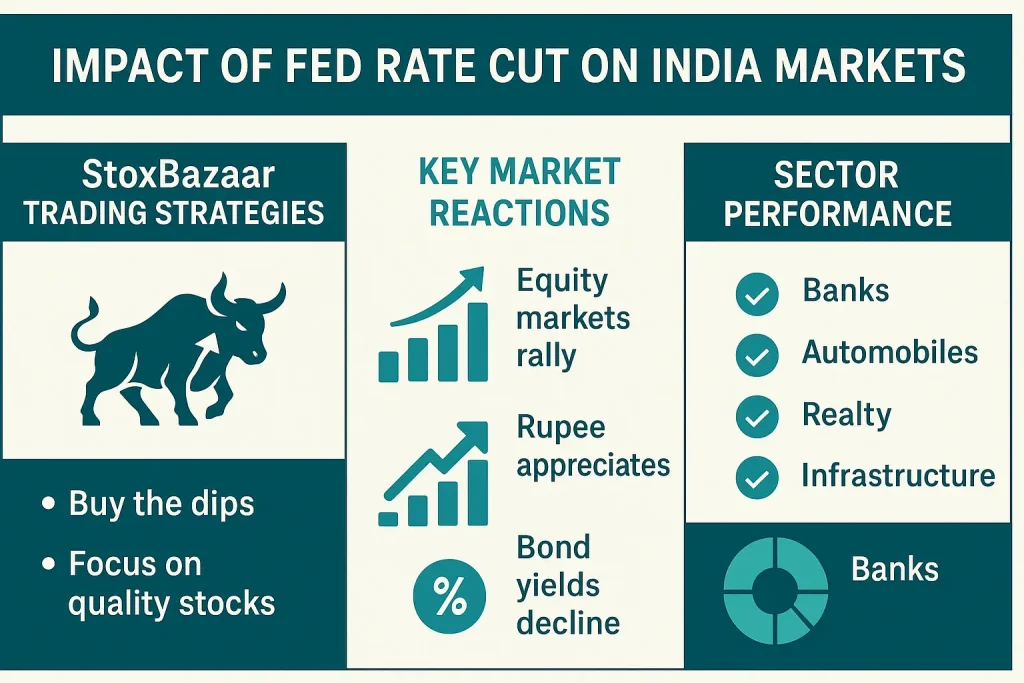

| Foreign Institutional Investors (FIIs) | One benefit of lower U.S. yields is decreased demand for U.S. bonds, and money will potentially move into developing markets like Indian stocks. | If sentiment remains strong, steady net FII inflows should help sustain index levels, especially in large caps/sectors with broader, global developments (IT, financials, etc.). |

| Dollar / Rupee / Currency Movements | When U.S. rate expectations soften, the dollar typically falls; this may also relieve cost pressures on the rupee. | The rupee remains stable or gains strength, which is good for the import-exposed corporates, reduces inflation risk, and supports consumer demand. |

| Bond Yields & Cost of Capital | A decline in U.S. yields tends to flatten or steepen yield curves in other countries, including in India, which can also see yields coming under downward pressure. | India could also see lower interest rates (if the RBI sees that inflation is being held in check), which would lead to reduced borrowing costs for both consumers and businesses, positive for growth sectors. |

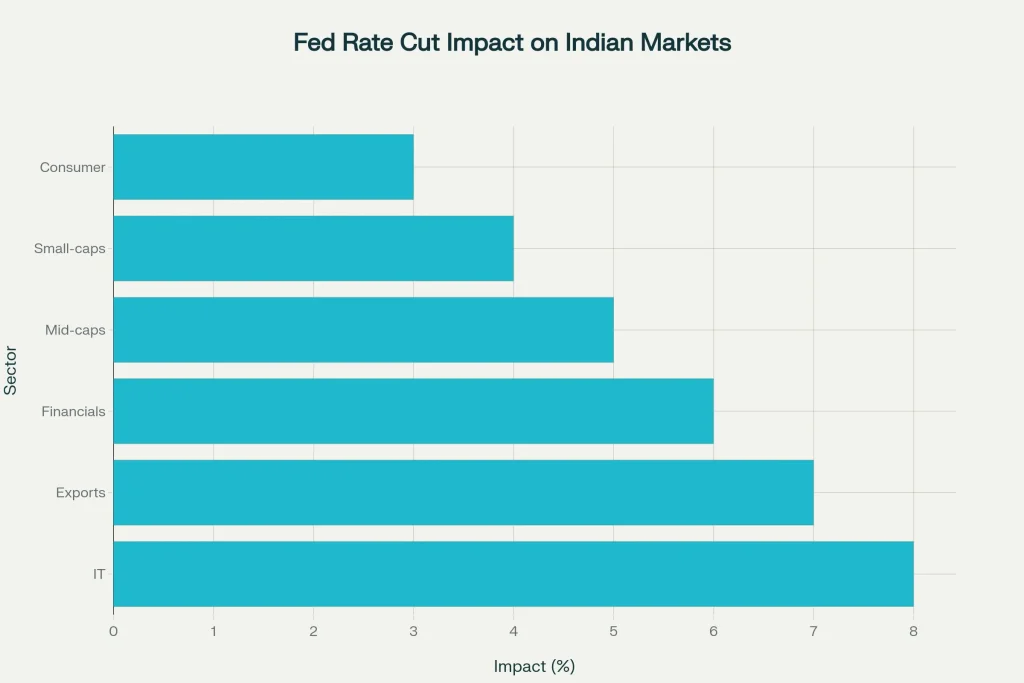

| Sectoral Impacts | The sectors generating revenue from the US (IT, exports) or those vulnerable to global liquidity are likely to benefit first. | Rate-sensitive sectors (housing, finance), exporters, and high P/E growth stocks could rally while the defensive sectors may lag if the economy stabilises. |

Real-Time Market Reactions

Here’s how the markets reacted right after the announcement:

- Sensex gained over 300 points, while Nifty50 went past the 25,400 levels.

- All IT sector stocks surged, given that many are forward-looking as companies derive revenues from the U.S. markets.

- Mid-caps and small-caps fared better by a few points (0.3-0.4%) during the morning as well.

- The rupee dipped below the ₹88/USD level due to a stronger dollar, even though the Fed lowered its interest rate.

What Traders Should Watch Going Forward

Here are signals and tactical considerations to look for:

-

Upcoming U.S. economic data

The payrolls, inflation, and consumer spending data could inform whether there are further cuts. Markets could react violently if these numbers create a surprise in either direction.

-

RBI Policy Stance

The Indian central bank could have some more room to consider cuts if global pressures came off and inflation settled. Should the RBI decide to cut rates, this may result in better outcomes for rate-sensitive sectors.

-

Foreign Flows

Daily FII/DII data is important. Should the inflows slip, it can reverse early purchase gains made in the market, especially in small / mid-cap stocks.

-

Currency

The rupee weakens to cut margins and heat inflation. However, if it strengthens, then the other way. Hedging or being cautious of forex risk is important.

-

Valuation & Earnings

Even in a decent macro environment, the valuation levels for some growth names (as an example) could be high. The expectation of earnings growth in sectors of financials, demand for consumption, and exports should justify the high multiples.

-

Global Risks

Supply chain constraints, inflation in the US, or geopolitical issues (trade policies and tariffs) could derail the change in sentiment rather swiftly.

Introducing Marketbhai & Strategies

Let’s discuss strategies. If you’re using Marketbhai (or comparable trading/investment platforms), the suggestions below will help you take advantage of this Fed action:

- Use the screening tools on Marketbhai to find stocks with significant U.S. revenue exposure (IT, software, exports), which tend to do well when the U.S. begins to ease rates.

- Be on the lookout for volume spikes in small-/mid-caps; often, the early movers will show up here first. Make sure to have liquidity filters, stop losses and tight control on risk.

- Keep an eye on the derivative markets (futures, options) by checking the Marketbhai dashboards; hedging or leveraging the positions, depending on your directional confidence, helps mitigate downside.

- Keep your alerts on for macro-economic releases (both U.S. & India) via the news feed so you can act quickly, in the event the narrative changes.

What This Means for Different Types of Traders

| Trader Type | What to Do Now | Risk Considerations |

| Short-term/Day Traders | Engage in trade momentum in sectors like information technology, exporters, and financials. Searching for opportunities after the opening volatility of reactions to the announcement is recommended. | Be cautious of a reversal pattern: Typically, after the initial excitement has passed, markets settle back in. Consider using a stop loss where appropriate. |

| Medium-term (1-3 months) | Position yourself in sectors that may have favourable movements down from global yields and more inflows from foreign trend channels. Paying attention to Reserve Bank of India (RBI) actions and the upcoming earnings season is prudent. | Valuations may be excessive. External shocks (oil price, currency movement) can be disruptive to trends. |

| Long-term Investors | Be focused on structural growth: stocks with quality earnings generation, good governance, international exposure, and diversification. | Be cautious of macro headwinds: inflation, policy changes, and global thinking can impair returns. |

Is This Rate Cut a Game Changer?

The 25 bps cut also appears to be largely priced in, according to many analysts. What matters more at this time is tone and guidance going forward. If the Fed proceeds with 1-2 more cuts, contemplating further cuts down the road, it will probably provide a great deal of support to risk sentiment globally, thus benefiting Indian equities. Conversely, if there are surprises in inflation or labour market data/upcoming data that may stop the Fed from hiking, we might see some short-term price correction in the markets.

Final Thoughts

If you are a trader looking to gain an edge, this is an opportunity to refine your toolkit more than to simply read the headline news. Platforms likeMarketbhai, that mix together real-time data, strong screening ability, derivative tools, and macro alerts, are really differentiators.

If you are serious about moving through the volatility and want to make informed choices, then Marketbhai is one of those platforms that provides a clean interface, timely market news updates, and tools that allow filter stocks by sectors / foreign exposure/derivatives. They are not biased and just provide the raw inputs you will use.

In Summary

- The Federal Reserve has reduced rates by 25 basis points and indicated two more rate cuts ahead, and growth and inflation remain the key pivots.

- Indian markets reacted positively, including the Sensex, Nifty, and especially IT, mid-caps, and small-caps.

- The rupee and bond yields are also sensitive to currency risk and inflation expectations globally.

- Traders should be observant of RBI movements, FII flows, earnings, and macroeconomic data from the U.S.

The importance of task structures, discipline, and proper risk management, and platforms such as Marketbhai will help clear edge versus the market, not obscure it.

Expand Your Trading Knowledge: Discover more market insights and trading strategies in our [comprehensive market analysis series](https://marketbhai.com/blog/nifty-50-trading-guide-best-trading-app-beginners/) to enhance your investment decisions.